:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2217820534-e108c6923d0f4dc99863438e53cb2373.jpg)

Key Takeaways

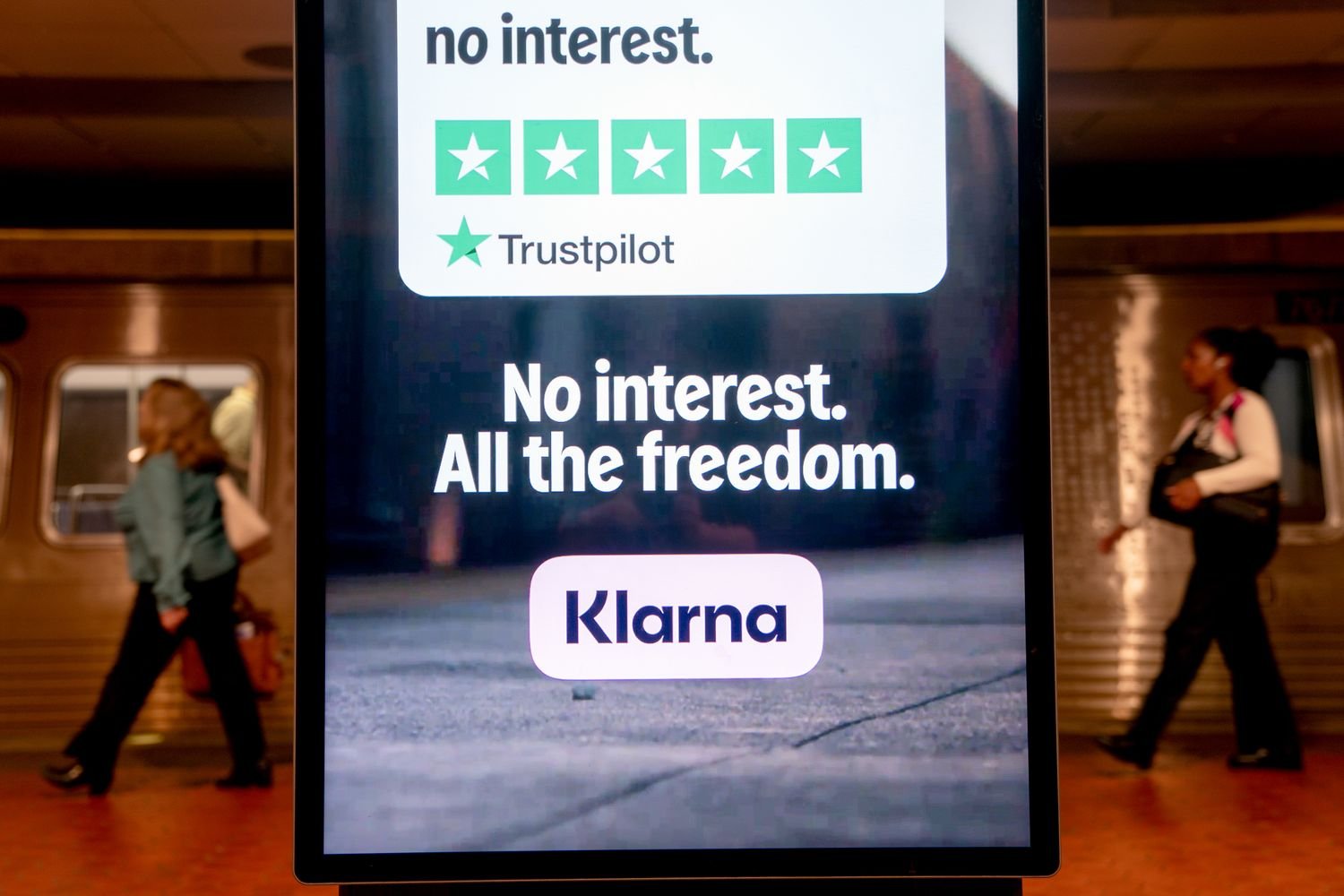

- Klarna and Afterpay, two Buy Now, Pay Later (BNPL) providers, say they won’t provide loan data to credit bureaus.

- The providers are concerned that BNPL loans, even those paid off on time, could harm their customers’ credit.

- FICO is rolling out new credit score models that incorporate BNPL loans into the scoring process. It says the move could raise the credit scores of responsible borrowers.

If you’ve paid for something using Buy Now, Pay Later loans from Klarna or Afterpay, you don’t have to worry about that harming your credit score.

FICO, the firm known for its credit score tools, is rolling out a pair of credit products this fall that incorporate data on consumers’ BNPL loans. But Klarna and Afterpay, two popular BNPL providers, say they won’t provide that data out of concern about the impact on their users’ credit scores—even those who make their payments on time.

Specifically, Klarna has concerns the FICO models will score short-term BNPL loans as if they’re traditional loans or new lines of credit, a spokesperson told Investoepdia. That would mean if someone used Klarna a few times a month, it might look as if they had opened multiple new credit cards, potentially harming their creditworthiness.

Afterpay’s parent company Block raised similar concerns in a recent blog post. The company said it will not share loan info with the credit bureaus “until we see concrete evidence that BNPL data reflecting responsible payment behavior will help, not hurt, the credit scores of our customers.”

FICO has said its new approach will aggregate multiple BNPL loans together, and it claims its approach has actually increased some borrowers’ credit scores. The company’s models were developed following a year-long joint study conducted with rival BNPL provider Affirm (AFRM), which does provide customers’ loan data.

Traditional lenders, meanwhile, are concerned about how BNPL debt contributes to borrower risk, especially for younger consumers, recent reports have shown. Consumer Financial Protection Bureau research found that borrowers under 25 had 28% of their debt from BNPL sources, compared to just 17% for other borrowers. The study also found that over 60% of BNPL users took out multiple loans during the year, and a third borrowed from several providers.

A recent news report said banks and lenders look down on loan and credit card applicants with frequent BNPL use, even if they make on-time payments, because they don’t know what the loans are for. They could indicate someone who is desperate for money to buy necessities, or who is using BNPL to buy things they wouldn’t have otherwise.

Fast Fact

While taking out a BNPL loan, even from Klarna and Afterpay, won’t necessarily impact your credit, missing payments can show up on your credit report if an unpaid loan is sent to a collection agency.

Source link